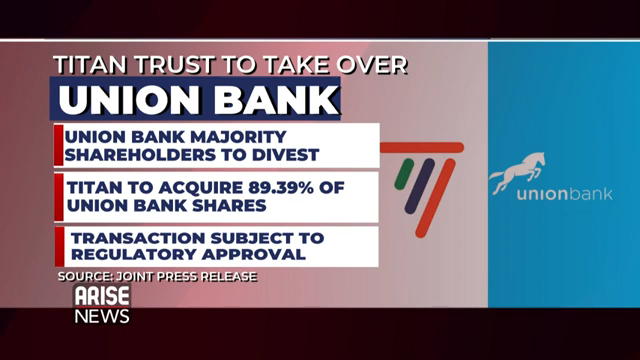

In an industry that thrives on both tradition and innovation, Titan Trust Bank has risen to the occasion as one of Nigeria’s promising financial institutions. With a focus on leveraging technology, Titan’s approach has resonated with the rapidly growing demand for better, more efficient banking solutions. Now, with its recent merger with Union Bank, Titan is poised to leave a lasting mark on the Nigerian banking landscape, an evolution that promises to shape the future of finance.

Before this milestone, Titan Trust Bank made a name for itself in Nigeria’s competitive banking sector. Founded in 2018, Titan has quickly moved from a start-up to a player capable of competing with long-established banks. The vision was clear: cater to the needs of micro, small, and medium-sized enterprises (SMEs), offering services that were agile, accessible, and responsive to the challenges that businesses face. This ability to quickly adapt and innovate has helped Titan carve a niche in an otherwise crowded market.

Now, with the recent merger with Union Bank, Titan Trust Bank has merged its brand of innovation with Union Bank’s rich legacy. While Titan may cease to operate as a separate entity, the merger elevates Union Bank to new heights, merging agility with stability. This is not just about strengthening market share—it’s about building a bank that is better positioned for the future.

Titan Trust Bank: Key Information

| Attribute | Details |

|---|---|

| Founded | 2018 |

| Headquarters | Lagos, Nigeria |

| Services | Personal, corporate, and SME banking |

| Key People | Tunde Lemo (Chairman), Emmanuel David Chukwudi (CEO) |

| Subsidiary | Union Bank of Nigeria (post-merger) |

| Key Focus | Financial inclusion, innovation, digital transformation |

| Website | Titan Trust Bank |

| Employees | 500+ |

| Licensing | Central Bank of Nigeria, National Banking License |

Why This Merger Matters

Mergers in the financial sector often have implications beyond just the numbers. In this case, the partnership represents an opportunity for a more inclusive, customer-focused banking experience. The consolidation of Titan Trust Bank’s agile, digital-first approach with Union Bank’s solid foundation creates a more robust and competitive financial powerhouse. As financial services continue to evolve, banks must stay ahead of the curve in delivering solutions that align with the changing needs of Nigerians.

This move is not just about physical branches or increased ATMs. It’s about blending the two institutions’ core strengths—Union Bank’s trusted history with Titan’s innovative mindset. The result? A combined force that will push forward financial inclusion, deliver faster digital banking services, and cater to customers across all segments, from retail to corporate.

This merger will also significantly impact SMEs, an area Titan has always been committed to supporting. By strengthening Union Bank’s infrastructure, this partnership promises to unlock new opportunities for businesses, especially those looking to integrate digital services into their operations seamlessly. This is an exciting time for SMEs, as they are no longer limited to the constraints of traditional banking but now have access to tools that will allow them to scale and compete on a global level.

The expansion of services—backed by a combined 293 service centers and nearly 1,000 ATMs—signals the strength of this collaboration. Customers can expect not only enhanced services at physical locations but a robust, seamless digital experience as well. The merger promises no disruption to existing services, ensuring that customers can still access their accounts and perform transactions with the same ease they’ve come to expect.

A Future Built on Trust

As Union Bank and Titan Trust Bank merge, the story is bigger than just corporate strategy. It’s about building a financial institution that champions the needs of Nigerians while embracing innovation and digital transformation. The leadership of both institutions is committed to this cause, with Union Bank’s CEO, Mrs. Yetunde Oni, highlighting that this is a pivotal moment in the bank’s 108-year journey. The goal is clear—create lasting value for customers, shareholders, and the broader community.

This merger underscores the importance of adaptability in the modern financial sector. As technology reshapes how we access and manage money, Titan Trust Bank and Union Bank stand as a testament to what is possible when two entities come together with a shared vision. Whether you are a long-time customer or someone seeking a more dynamic banking experience, this move is a game-changer that aims to redefine how Nigerians interact with their financial institutions.

This merger is a forward-looking strategy that positions both Union Bank and Titan Trust Bank as major players in Nigeria’s financial sector. By blending the best of both worlds—innovation with tradition—the merger sets the stage for a more inclusive, tech-driven, and customer-centric banking experience. It’s a game-changing move that not only enhances the customer experience but also paves the way for future financial innovation in Nigeria.

As we watch the consolidation of these two entities unfold, one thing is certain: Union Bank’s partnership with Titan Trust Bank will be a powerful force that shapes the future of banking in Nigeria.